- Seller Snacks by FBA Lead List

- Posts

- 🧠 Sourcing Isn’t the Problem Anymore

🧠 Sourcing Isn’t the Problem Anymore

What OA sellers need to adjust before testing, replenishing, and scaling in 2026.

Welcome back to Seller Snacks, your weekly buffet of ecommerce goodness.

🧾 If you’re reading this on the 15th, it’s officially Q4 tax deadline day -- so whether your taxes are filed or still “almost done” in another tab, welcome back to Seller Snacks. Grab a coffee, take a breather, and let’s talk shop.

🍔 This week in Seller Snacks: why testing beats sourcing, how review changes affect OA buys, what DD+7 means for your cash flow, and the updates that matter before you restock another ASIN.

On Today's Menu:

Let’s eat!

🧠 Sourcing Isn’t the Problem Anymore – Testing Is

In the latest Silent Sales Machine Radio – Coach’s Corner, Brian and Robin Joy Olson challenged a belief many Amazon online arbitrage sellers still hold:

“Sourcing is the hardest part of the business.”

Thanks to bulk matching tools like ArbiSource, lead lists, and Keepa, finding ASINs has largely been solved. What separates profitable sellers from frustrated ones is what happens AFTER the ASIN is found.

That’s where most OA sellers get stuck.

The Real Bottleneck: Confusing “Finding” With “Validating”

Many sellers treat a good Keepa chart as proof of profit. But charts only show what has happened, not what will happen.

Amazon’s marketplace today includes:

a multi-dimensional buy box (different prices by region)

delivery-time-driven sales (speed often beats price)

inventory placement you can’t control

buy box behavior that doesn’t fully show up in tools

In short: Keepa can’t show you reality. Only a test can.

The Framework That Actually Works

Brian and Robin Joy break it down using the PATH system:

Prospect – gather ASINs

Assess – check velocity, capital risk, and profit potential

Test – send small quantities to see what’s real

Harvest – replenish only what proves itself

This is how sellers build a book of business instead of chasing one-off wins.

Why This Matters for OA Sellers

If you’re constantly sourcing but not scaling, it’s usually because:

you’re over-trusting charts

under-testing products

or trying to predict profit instead of letting data reveal it

Testing turns guesswork into decisions.

How Lead Lists Support the “Prospect” Step of PATH

High-integrity lead lists don’t replace testing. Instead, they can power the Prospect stage of the PATH framework.

FBA Lead List provides a consistent stream of pre-matched and pre-vetted ASINs, so instead of spending hours hunting for ideas, you can focus on:

assessing with clear criteria

testing quickly and cheaply

harvesting only proven winners

When “Prospect” is handled efficiently, the rest of PATH becomes easier to execute.

The edge isn’t finding more products.

It’s feeding your testing system with better inputs, consistently.

If Prospect is your bottleneck, FBA Lead List helps remove it, so your PATH system keeps moving and your testing pipeline never runs dry.

⭐ Amazon Is Changing How Variation Reviews Work — What OA Sellers Need to Adjust

Starting February 12, 2026, Amazon will begin limiting how reviews are shared across product variations, rolling out by category through May. Reviews will no longer be pooled across functionally different variations, which means some child ASINs will lose review count and star rating support.

For OA sellers, this isn’t a listing tweak; it’s a sourcing risk shift.

Why this matters for OA sourcing

Many OA sellers rely on variation listings where:

the parent ASIN has strong reviews

individual child ASINs benefit from that shared credibility

Once reviews are separated:

conversion can drop overnight

previously “safe” replens may stall

slowdowns can happen without price or rank changes

What to watch before you buy

When sourcing or replenishing a variation ASIN, start asking:

Does this child ASIN have its own meaningful reviews?

Are the variations truly minor (color, pack size), or do they affect use or expectations?

Would this ASIN still convert if reviews weren’t shared?

If the answer is no, it’s a higher-risk test, even if Keepa looks solid.

Seller Snack takeaway

In 2026, OA-friendly ASINs aren’t just about charts; they’re about standalone conversion strength. Treat every variation like it may soon stand on its own.

💰 Why DD+7 Is the Next Cash Flow Squeeze for OA Sellers

Most sellers are already focused on FBA fee increases: higher fulfillment costs, storage, and tighter margins. But quietly, Amazon’s move to DD+7 payouts creates a second cash-flow problem that hits OA sellers just as hard.

Quick explainer:

Under DD+7, Amazon releases your funds 7 days after delivery, not shortly after shipment. That means your capital sits with Amazon longer – even though sourcing, prep, and restocking costs are paid up front.

So while fees reduce how much you make, DD+7 affects how fast your money comes back.

For OA sellers who rely on rapid inventory turns, this delay can mean:

fewer replenishments

missed time-sensitive deals

slower capital compounding

In short: your cash flow slows even if sales don’t.

That’s where Payability becomes less of a “nice-to-have” and more of a cash-flow stabilizer.

Payability gives OA sellers access to a large portion of their Amazon revenue daily, keeping capital moving even as Amazon’s payout timeline stretches.

Why this matters now:

Fee increases squeeze margins

DD+7 slows reinvestment

OA businesses live or die by cash velocity

👉 If cash flow is already tight, DD+7 will expose it.

If you want to keep sourcing aggressively, restocking winners on time, and compounding capital despite Amazon’s slower payouts, now is the time to explore Payability – before DD+7 forces reactive decisions.

🎓 This Week in FBA Lead List Academy

📈 How One Seller Built a 3,800-ASIN Lead Database in 12 Weeks

Brian and Robin Joy Olson break down a client case study showing how one seller used daily sourcing targets, strict ASIN validation, and simple tracking systems to build a deep, testable lead database fast.

Key takeaway: consistent inputs + clean data beat “hero sourcing days” every time.📉 Why Most OA Losses Start Inside Keepa

This post explains how misreading Keepa signals – like ignoring price history, misjudging rank movement, or misunderstanding buy-box dynamics – is often the real source of losing ROI on supposedly “good” deals.

Key takeaway: sharpening your Keepa analysis helps you avoid dead-end lead list entries and protects margins before you ever buy.💸 Amazon FBA Fees Increase Today – Here’s What Breaks First

This post breaks down which fee buckets shift first when Amazon bumps FBA costs – from fulfillment and storage to prep and handling – and how that pressure point shows up in real seller margins.

Key takeaway: knowing which fees move first helps you spot margin risk early and adjust your lead list price thresholds before deals go red.

🗞️ Essential Amazon Seller Updates

⭐ Amazon Changes How Reviews Share Across Variations (Starting Feb 12)

Amazon will stop sharing reviews across significantly different variations, which could lower visible star ratings or review counts on some ASINs. The rollout will happen by category from Feb 12–May 31, 2026, with 30-day email notice before your listings are affected.

📦 Prepaid Return Labels Now Required for All Seller-Fulfilled Returns (Feb 8)

Starting Feb 8, 2026, Amazon will require prepaid return labels for all SFP returns, including high-value items. This removes the old exemption and cuts refund timelines from 14 to 7 days.

OA takeaway: expect faster refunds and higher exposure on expensive items; price in return risk and be ready to use SAFE-T claims when refunds aren’t your fault. Category exemptions still apply.

⚡ Quick Clicks — Headlines Worth a Glance

📦 Amazon Business Expands Prime Perks for SMBs

Amazon Business added new Business Prime benefits, including discounts on QuickBooks, Gusto payroll, and CrowdStrike cybersecurity, on top of existing shipping and spend tools. Worth a look if you’re already a member or evaluating Prime for back-end efficiency.📊 2026 FBA Fee Changes: What OA Sellers Should Adjust Now

A breakdown of upcoming 2026 FBA cost changes that will quietly squeeze margins.

OA takeaway: re-run Keepa on older ASINs, cut slower movers before long-term storage hits, tighten buy costs, and be extra cautious on low-priced or oversized items where fee jumps hurt the most.🚨 The Account Health Mistake That Can Sink OA Sellers

Chris McCabe explains why the “just wait 180 days” approach is risky.

OA takeaway: old IP complaints and policy hits don’t vanish; Amazon can resurface years-old issues, so ignoring or auto-acknowledging violations increases suspension risk instead of reducing it.

🎭 Meme of the Week

Because Amazon selling is serious business… but not too serious.

Want more sourcing memes, weekly drops, and a few laughs between IP claims?

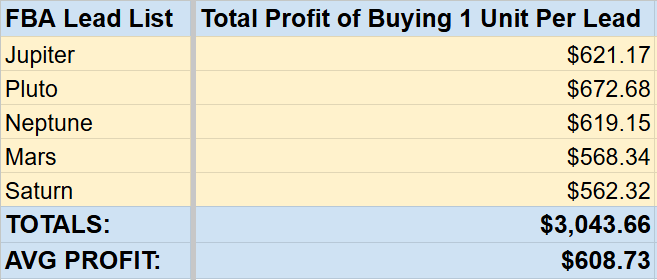

Last week (1/5/26 to 1/9/26), our lead lists delivered:

🔍 Unique Top Leads: 248

💰 Avg. Net Profit: $11.94

📈 Avg. ROI: 79.22%

🏷️ Avg. 90 Day Rank: 156,148

💸 Total Profit (all lists, buying 1 unit per lead): $3,043.66

This is what you could’ve pocketed buying just one unit per lead from our daily lists last week:

How our service works:

We deliver 10+ expert-vetted OA leads to your inbox Monday - Friday

IP/brand/price-cliff filtered, top 1.5% sales rank targets, 85% avg ROI, $14 avg net profit/unit

Built for speed so you turn inventory fast = optimized cash flow

Lists are seat-capped to avoid saturation.

One flip can cover your monthly subscription

Here’s what some of our long-time subscribers had to say:

⭐⭐⭐⭐⭐

“Better and more cost-effective than any VA I have hired on my own. This has been a real game-changer for me, and I really do appreciate the hard work everyone puts into making this happen.” - Ken

⭐⭐⭐⭐⭐

“Great multi-use list: use for rabbit-trailing off store, brand, coupon, category, or just buy daily leads outright, rarely tank, well-vetted, excellent variety. “ - SC

⭐⭐⭐⭐⭐

“I was able to build my business just using these leads, it's been a great experience for me.” - JC

Lists capped at 44 and 22 sellers per list. Starts at $185/mo.

No long-term commitments. Try our lists risk-free.

🤝 Let's Partner Up

Are you an influencer, content creator, or Amazon expert with value to share? We’re always looking for new ways to grow together.

Here’s what we’re excited to explore:

Sharing your content in our newsletter or socials

Offering exclusive deals to our subscribers

Co-creating content that helps sellers scale smarter

Got an idea for a win-win partnership?

📩 Email us at [email protected] — let’s build something great together.

Some links may be affiliate links. We may get paid if you buy something or take an action after clicking one of these. We appreciate the support.

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.