- Seller Snacks by FBA Lead List

- Posts

- Scarcity = Profit? The Stockout Playbook for Q4

Scarcity = Profit? The Stockout Playbook for Q4

Discover why shortages can boost OA margins, plus repricing tactics for Prime Big Deal Days.

Welcome back to Seller Snacks, your weekly buffet of ecommerce goodness.

This week, we explain how retailer stockouts can turn into premium OA profits, lay out repricing tactics to use this coming Amazon Prime Big Deal Days, share insights from Brian and Robin Joy Olson on building an OA business centered around profit, reveal the blueprint for building a sustainable and scalable OA business, and break down a pawsome doggie backpack flip.

Also, Q4 is about to heat up, and smart sellers are locking in leads now to stay ahead. Don’t miss out, secure your spot before our lists close out.

Whether you’re flipping, sourcing, or binge-scrolling Keepa: grab a plate, we don’t judge.

Table of Contents

Let’s eat!

🥨 Crisp Intel

Bite-sized insights to help you sell smarter.

📆 What’s Happening: Retail Stockouts = Q4 OA Opportunity

A new survey shows 76% of retail managers are facing more stockouts, and 59% can’t replenish shelves fast enough, thanks to ongoing shipping delays, tariff-driven price hikes, and consumers panic-buying earlier than usual. While bad news for brick-and-mortar stores, this presents a potential windfall for online arbitrage sellers. Scarcity in local stores often drives consumers online, where they’ll pay premiums for hard-to-find items.

📈 Why It Matters

Scarcity is profitable (BUT not automatically) - Some stockouts happen because demand is spiking (great for OA), while others are due to retailers cutting orders on slow movers (bad bet). Always check velocity and rank before diving in.

Regional disparities are real - To borrow from Chris Grant, a “hot” holiday item might vanish from shelves in a big-city Target within hours, but the same item could sit in stock for days at a smaller-town Walmart. And the same thing happens online: when Amazon and Target.com sell out fast, regional or niche e-commerce sites (like Kohl’s, Meijer, or specialty toy shops) may still have inventory. Resellers who think beyond the obvious channels, both in-store and online, can capture those price gaps and flip what’s scarce elsewhere.

Competition will intensify - Q4 always attracts new and seasonal sellers. If you only chase the “headline toys” or viral items, you’ll be swimming in a red ocean. Look for niches and replenishable leads that hold up under pressure.

Supply chain pain = pricing upside - Tariffs, shipping delays, and panic buying add fuel. Listings with consistent demand and thin supply histories often see strong price floors through the holidays.

📋 What to Do:

✅ Validate before you buy - Use Keepa/BSR data to confirm demand, not just assume stockouts = profits.

✅ Hunt the overlooked - Smaller chains, regional stores, or less-trafficked retailer sites are goldmines when big-box shelves are empty.

✅ Double down on winners - Once you confirm velocity, don’t be bashful about going deeper. Q4 momentum snowballs.

✅ Avoid the tank traps - Don’t chase the “too obvious” hot toys (if you can sell them) or fad items without a clear read on competition and margin.

💡Tired of chasing unprofitable leads? Our Q4 lead lists are designed to find overlooked winners with scarcity-driven upside that most sellers miss. Spots are limited, so now’s the time to secure yours and ride the holiday wave.

🍪 OA Munch

Bite-sized tips to boost your flips.

⚡ Prime Big Deal Days Repricing Strategy

Amazon’s Big Deal Days (Oct 7–8) is a 48-hour sprint where the Buy Box moves faster than usual. In this thread, we break down four repricing tactics (including micro price tests and price looping) OA sellers can use to win sales without tanking profits and protecting inventory for the bigger Q4 wave.

👉 Pro tip: Instead of setting up endless manual price increments, you can use a budget-friendly repricer which automatically finds the optimal pricing points for you. That means you can run micro price tests and price-looping on autopilot, saving time while staying competitive during Big Deal Days.

💳 Q4 Funding Edge

Q4 is when inventory needs outpace cash flow, and the right business credit card can be your secret weapon. Beyond rewards, a solid card gives you 0% intro APR options, extra float on payments, and the capital to move fast when opportunities hit. Check out this guide to the best business credit cards to set yourself up before Q4 demand peaks.

📊 Know Your True Inventory Value

Tools like InventoryLab are great, but they don’t capture everything like units in transit, at prep centers, or sitting in your death pile. Chris Potter shared two free resources that fix this: an inventory valuation calculator and a guide to calculating year-end FBA levels. Both will give you a clearer picture of your business and help you prep for taxes the right way.

🍄Mental Snacks

Quick Bites. Better Mindset.

In a recent Coach’s Corner episode of Silent Sales Machine Radio, Robin Joy and Brian Olson reminded sellers that sales alone don’t guarantee success. Gold bars on your Seller app feel good, but they’re “empty calories” if you slash prices just to chase volume. The sellers who thrive are the ones who build around profit, not just sales.

According to the Olsons, here’s how to reframe your mind to be able to do so:

📌 Kick the Addiction to Sales Dopamine

Rapid-fire orders don’t matter if the margin isn’t there. Celebrate sales, but measure success by profit, not refreshes.

👉 Reframe: “Did I make money?” outranks “How many orders?”

📌 Price According to Supply

If you can only source six units, price them like six, not sixty. Racing to the Buy Box just burns inventory and margin.

👉 Practice: Set a target sell-through that matches your actual supply.

📌 Test with Discipline

Slashing prices too soon ruins your test. Data matters more than instant movement.

👉 Protocol: Hold price during tests to get clean results before tweaking.

📌 Trade Quantity for Quality

Ten sales at 20% profit isn’t equal to five at 40%. The higher-margin path means less work for the same dollars.

👉 Upgrade: Replace low-margin fillers with higher-profit winners as they come.

📌 Build a Flywheel Around the Best

Cut your bottom 20%. Double down on the profitable top 20% and look for patterns you can replicate.

👉 Focus: Make your best ASINs your sourcing blueprint.

📌 Exponential > Incremental

Scaling inefficiency just multiplies bad habits. For example, a student of theirs who eased off aggressive repricing cut sales by a third — BUT grew profit 140%.

👉 Aim: Compound small improvements that make a big impact.

Why This Matters Now

In Q4, the sellers who win aren’t chasing every sale – they’re hunting “meaty beasts”, pricing with discipline, and aiming for quality over quantity.

🍿 Snacktacular Spotlight

Each week, we shine a light on something (or someone) that’s helping Amazon sellers snack smarter.

This week’s spotlight is on….

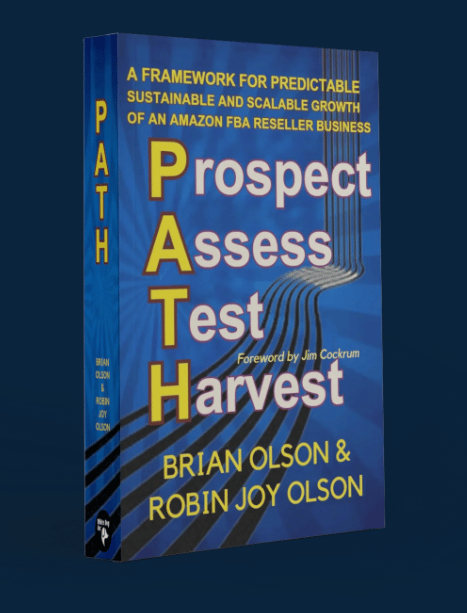

📖 P.A.T.H.: Build a predictable, sustainable, and scalable Amazon online arbitrage business

In this week’s Mental Snacks, we highlighted Robin Joy & Brian Olson’s lesson on building a business around profit, not just sales. That same philosophy is at the heart of their book, P.A.T.H., a step-by-step framework designed to cut through the FBA noise and give sellers clarity and confidence.

The P.A.T.H. Framework breaks the reseller journey into four powerful phases:

🔎 Prospect – Spot real product opportunities with their Pre-Flight Inspection.

📊 Assess – Run picks through the 3-Step Check to make smart, low-risk decisions.

🧪 Test – Use the 4-Week Testing method to gather real sales data without overcommitting.

🌾 Harvest – Build a reliable book of replenishable ASINs that keep profits growing.

Along the way, you’ll also sharpen your Keepa skills, avoid price-war traps, and build systems that let you scale without burning out.

Readers are already seeing the impact:

🥣 The Dip Bowl

Click-Worthy Finds Served Fresh

Peak Season Fees: check out the peak season shipping rates from UPS, USPS, FedEx, and Amazon. Don’t be blindsided.

The VA ROI Equation: find out if you’re getting the most bang out the buck you’re investing in your VAs.

Amazon’s Unknown Fees: Amazon is already investigating reports of sellers being subjected to mystery fees.

🎭 Meme of the Week

Because Amazon selling is serious business… but not too serious.

Want more sourcing memes, weekly drops, and a few laughs between IP claims?

🤝 Let's Partner Up

Are you an influencer, content creator, or Amazon expert with value to share? We’re always looking for new ways to grow together.

Here’s what we’re excited to explore:

Sharing your content in our newsletter or socials

Offering exclusive deals to our subscribers

Co-creating content that helps sellers scale smarter

To profitable sourcing,

Caitlin and Brian

📩 Email us at [email protected] — let’s build something great together.

Some links may be affiliate links. We may get paid if you buy something or take an action after clicking one of these. We appreciate the support.