- Seller Snacks by FBA Lead List

- Posts

- 🤫 Quiet Profit Season Starts after Xmas

🤫 Quiet Profit Season Starts after Xmas

Post-holiday Q1 spikes, the fee changes that matter most in Q1, plus a fresh play on apparel and refunds to keep your margins safe.

Welcome back to Seller Snacks, your weekly buffet of ecommerce goodness.

📢 Exciting December News: FBA Lead List is the December Sponsor of the Month for Jim Cockrum’s MySilentTeam Facebook community.

The MySilentTeam Facebook group has the biggest collection of real, recent Amazon success stories we’ve seen, and is also the home of Jim Cockrum’s top rated Amazon seller training program ProvenAmazonCourse.

If you’re serious about building your Amazon online arbitrage business, this private community is packed with spam-free support, newbie-friendly coaching, and thousands of seller wins you can easily learn from.

👀 ICYMI: Also, our COO Brian Elfstrom recently sat down with Jim and had a great conversation about the evolution of online arbitrage and how lead lists have become key assets in building a sustainable, profitable Amazon online arbitrage business. You can watch the full episode here.

🍔 This week in Seller Snacks: the “quiet” profit season most sellers miss, dodging Q1 Amazon fee landmines, why Amazon becoming the #1 clothing seller matters, and more…

On Today's Menu:

Let’s eat!

🤫 Post-December to February: The “Quiet Profit Season” Most Sellers Miss

December isn’t the finish line anymore. Amazon’s 2025/2026 sale rhythm keeps buyers in deal mode into early Q1, so Dec 26 → Feb has multiple real demand spikes if you’re stocked early.

What to expect:

Early–mid January = New Year / Winter clearance + “resolution” buying. Fitness, organization, health, home refresh, and discounted leftover gift categories move fast.

Late Jan → Feb 14 = Valentine’s gifting surge. Shoppers are mission-buying gifts, so “giftable” items win.

Mid-Feb (Presidents’ Day window) = second clearance wave. Especially strong for home, small appliances, and winter closeouts.

The Play:

Buy/inbound earlier than you think. Micro-sales + quick category spikes mean waiting for announcements puts you behind the inbound curve.

Source with two lenses:

January: “better-me” items (fitness, planners, storage, healthy-kitchen, winter care)

February: “gift-me” items (beauty/fragrance sets, candy/snack giftables, cozy/home vibe, accessories, plush/collectibles).

💡 Quick note: 2026 Q1 winners won’t be the sellers who find a couple of seasonal leads. The winners will be the ones who have a steady pipeline of high ROI, fast-moving leads. Our lists provide you with a steady baseline of proven OA opportunities along with leads that match the January/February demand. Sure beats spending endless hours hunting the whole world wide web cold.

Premium lists ($185/mo) • Elite lists ($349/mo)

Lists capped to prevent saturation and race to bottom

No long-term commitments. Try our lists risk-free. One flip can cover your monthly fee.

Bottom line: treat Jan–Feb like its own season. The clearance buys are cleaner, the competition is lighter than Q4, and the demand is way more predictable than most sellers realize.

💣 Q1 2026 Fee Landmines to Watch (and How to Dodge Them)

Q1 is when a few specific 2026 fee changes start biting. For now, shift your focus from the headline “average +$0.08” and give attention to these:

Peak fees don’t end until Jan 14.

Holiday peak fulfillment rates stay in place through January 14, 2026, so early-Jan margins are still Q4-tight. Your real “new fee world” starts January 15.Small standard-size increases hit right away.

Starting January 15, small standard items get the sharpest bumps (especially $10–$50 and >$50 price bands). If that’s your OA lane, Q1 profit will feel this first.Aged inventory surcharges jump in Q1.

These kick in immediately with the 2026 schedule, so slow movers can get expensive fast.12–15 months: $0.30/unit

15+ months: new tier at $0.35/unitRemoval/disposal is cheaper for lightweight aged stock.

Fees for standard-size aged items <0.5 lb drop $0.20/unit, basically nudging you to clear dead inventory earlier.Inbound fees reward “Amazon-optimized” splits.

Q1 shipments choosing minimal splits pay higher inbound placement fees, while Amazon-optimized splits stay $0 for many tiers. Plus, inbound defect fees can hit if cartons/pallets are mislabeled or misrouted.

Quick Q1 action plan:

☑ Re-run the numbers on your repeat ASINs with the post - Jan 15 fees (small standard $10+ items need the closest look)

☑ Let a repricer enforce new ROI floors so fee bumps don’t quietly erase margin.

💡 Aura’s Auto Min/Max Pricing can easily lock in your new ROI floor for every SKU, so even if the market drops in Q1, your prices won’t slide below profitability under the 2026 fees.

☑ Clear anything drifting toward 12 months while removal is cheaper to avoid stiff storage penalty fees.

☑ Use Amazon-optimized shipment splits whenever possible and double-check carton/pallet compliance to avoid inbound fees.

☑ Plan January cashflow assuming peak fees through Jan 14, then reassess pricing after Jan 15.

👕 Amazon Is Now the #1 Clothing Seller — Why You Should Care

Amazon quietly became America’s biggest clothing retailer, pulling in roughly 16%+ of U.S. apparel spending and passing Walmart. They didn’t win by being trendy — they won because shoppers default to Amazon for basics, convenience, Prime shipping, and endless selection from third-party sellers. For OA sellers, that means apparel isn’t a side category anymore; it’s a year-round traffic engine.

What this changes for OA sellers:

“Basics” are the money lane

Amazon’s apparel dominance is built on boring, repeat-buy items — tees, socks, underwear, leggings, kids’ everyday wear, seasonal layers. These are exactly the kinds of products retail stores carry deep and discount hard.More 3P whitespace

Amazon has scaled back many of its private-label clothing brands, leaving more room for third-party sellers to fill demand in basics and niches.Clearance waves get more dependable.

When big box stores rotate seasons, OA sellers can scoop end-of-season basics bundles, kids apparel after holidays/back-to-school, and cold-weather closeouts in Jan–Feb. With Amazon now the top apparel destination, those flips have more consistent demand behind them than before.

Quick playbook:

Source boring-but-reliable apparel during retail clearance resets.

Favor standardized basics; avoid niche fits or odd size runs.

Clothing, Shoes, and Apparel are high-return categories. Keep a margin cushion to absorb returns.

Think steady lane, not holiday-only.

Bottom line: Amazon becoming the biggest clothing seller is a green light for OA. Lean into basics + clearance timing, and apparel can be a quiet, repeatable profit lane in 2026.

🎓 This Week in FBA Lead List Academy

🧮 Run This 2026 Re-Up Check Now: a quick 15-minute “fee stress test” to make sure your top replens still clear profit once the mid-January fee changes hit — before Q1 quietly thins your best winners.

💰 How to Turn Amazon’s New Refund Rule Into a Q4 Margin Win: Amazon now lets you issue partial, returnless refunds — here’s the OA playbook to cut return costs, set smart refund bands, and protect margins through Q4.

🚨 Prep Warning for Next Year: inbound defect fees start Jan 15 and can turn small shipment mistakes into big per-unit losses — here’s a 2-minute QA checklist (plus a clean pipeline tip) to keep your Q1 profits safe.

🗞️ Essential Amazon Seller Updates

📦 New FBM Features Are Live: Amazon just added seller-set holidays, location-based shipping controls, clearer delivery-date breakdowns, and easier multi-location inventory—so FBM sellers can stay visible while closed and promise more accurate delivery dates without juggling vacation mode.

💸 Returnless Resolutions by Price (US) Is Here: You can now set a $1–$75 threshold so eligible FBA items get refund-without-return offers—saving you return shipping, processing, storage, and removal costs while Amazon screens for abuse.

🧮 Amazon Revenue Calculator Got Smarter: You can now preview current vs. 2026 fees (including inbound placement/removal) right inside the Revenue Calculator or inline dashboards—perfect for re-checking replens and vetting new ASINs before Q1.

⚡ Quick Clicks — Headlines Worth a Glance

🚚 Amazon Testing 30-Minute “Amazon Now” Delivery: Amazon is piloting half-hour delivery for groceries and household essentials in parts of Seattle and Philly (paid add-on), a big signal that “everyday essentials” are getting even more Prime-favored visibility and faster-turn demand.

🕵️ Inside Amazon’s Counterfeiter Crackdown: Amazon’s Counterfeit Crimes Unit (a specialized ex-prosecutor/agent team) is scaling up global investigations with brands and law enforcement, seizing millions of fakes—meaning Amazon is getting tougher on authenticity, so OA sellers should stay sharp on invoices, sourcing trails, and brand-sensitive ASINs.

🤖 Amazon Blocks ChatGPT Shopping Access: Amazon updated its robots.txt to stop ChatGPT’s shopping/research bots from reading Amazon listings, prices, and reviews—basically keeping AI shopping agents from surfacing Amazon deals and steering buyers elsewhere.

🎭 Meme of the Week

Because Amazon selling is serious business… but not too serious.

Want more sourcing memes, weekly drops, and a few laughs between IP claims?

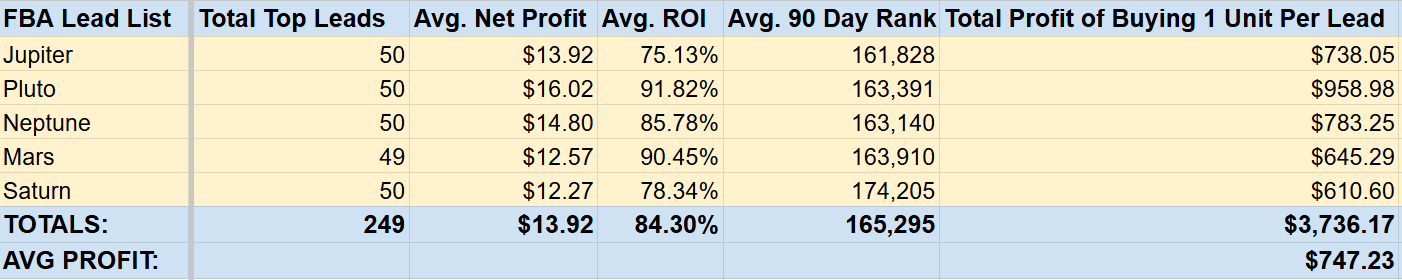

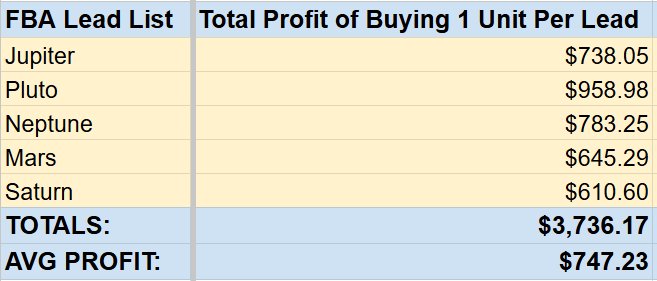

Last week, our lead lists delivered:

🔍 Unique Top Leads: 249

💰 Avg. Net Profit: $13.92

📈 Avg. ROI: 84.30%

🏷️ Avg. 90 Day Rank: 165,295

💸 Total Profit (all lists, buying 1 unit per lead): $3,736.17

This is what you could’ve pocketed buying just one unit per lead from our daily lists last week:

How our service works:

We deliver 10+ expert-vetted OA leads to your inbox Monday - Friday

IP/brand/price-cliff filtered, top 1.5% sales rank targets, 85% avg ROI, $14 avg net profit/unit

Built for speed so you turn inventory fast = optimized cash flow

Lists are seat-capped to avoid saturation.

One flip can cover your monthly subscription

Here’s what some of our long-time subscribers had to say:

⭐⭐⭐⭐⭐

“Better and more cost-effective than any VA I have hired on my own. This has been a real game-changer for me, and I really do appreciate the hard work everyone puts into making this happen.” - Ken

⭐⭐⭐⭐⭐

“Great multi-use list: use for rabbit-trailing off store, brand, coupon, category, or just buy daily leads outright, rarely tank, well-vetted, excellent variety. “ - SC

⭐⭐⭐⭐⭐

“I was able to build my business just using these leads, it's been a great experience for me.” - JC

Premium lists ($185/mo) • Elite lists ($349/mo)

Lists capped to prevent saturation and race to bottom

No long-term commitments. Try our lists risk-free. One flip can cover your monthly fee.

🤝 Let's Partner Up

Are you an influencer, content creator, or Amazon expert with value to share? We’re always looking for new ways to grow together.

Here’s what we’re excited to explore:

Sharing your content in our newsletter or socials

Offering exclusive deals to our subscribers

Co-creating content that helps sellers scale smarter

Got an idea for a win-win partnership?

📩 Email us at [email protected] — let’s build something great together.

Some links may be affiliate links. We may get paid if you buy something or take an action after clicking one of these. We appreciate the support.

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.