- Seller Snacks by FBA Lead List

- Posts

- 😬 Did You Miss This Amazon Fee Update?

😬 Did You Miss This Amazon Fee Update?

Fee hikes, repricer meltdowns, and the one sourcing move sellers are making before January’s big changes hit.

Welcome back to Seller Snacks, your weekly buffet of ecommerce goodness.

This week, we zoom in on major glitches and outages that affected OA sellers recently, managing peak FBA fees, and Amazon’s 2026 fee hike.

Also, are you feeling the Q4 heat yet? FBA Lead List subscribers are locking in leads NOW to maximize Q4 profit. Don’t miss out, secure your spot before our lists close out (most are already wait-listed, don’t miss your chance!)

Whether you’re flipping, sourcing, or binge-scrolling Keepa: grab a plate, we don’t judge.

On Today's Menu:

Let’s eat!

🔌 Repricer Meltdown + Amazon Blackout

First came the repricer meltdown. Late last week, a popular repricer, a tool many sellers rely on to automate Buy Box pricing, glitched and sent listings spiraling below mins, some as low as $1. Sellers scrambled to pause automation, reset rules, and stop the profuse bleeding. For anyone running lean on Q4 margins, it was a gut punch.

If this incident proved anything, it’s that your repricer can’t just be fast – it also has to be SMART.

We asked our lead list subscribers about their preferred repricers, and a good number of them recommended Aura. They say its AI-powered engine keeps their margins protected, and doesn’t flinch too easily when prices shift, keeping them competitive. It’s also not cost-prohibitive (starts at $37/month), and offers a free 14-day trial. Set up may be trickier compared to other repricers, so make sure to go through their onboarding process so that you can set it up just the way you want.

Then the hits kept on coming.

Sourcing ground to a screeching halt for a couple of hours last Monday when Amazon’s own AWS network went down, freezing listings, blocking product pages, and crippling sourcing tools across the web. OA sellers couldn’t check prices, analyze Keepa charts, or even open Amazon listings to buy. The crash also couldn’t have happened at the worst time, as OA sellers are focused on scaling their buys to max profit in Q4.

Both crashes hit where it hurts most: speed and control. The takeaway? Automate smartly, but always keep a manual playbook ready.

🧭 Peak FBA Fees Are Here: Here’s How to Keep Your Margins Intact This Q4

We’re about to get into the thick of Q4, and Amazon’s holiday peak fulfillment fees have been live since October 15, and they’ll stick around until January 14.

That means every sale you make through FBA this holiday season costs just a little more to fulfill. And it’s not just Amazon – UPS, FedEx, and USPS all have peak surcharges running right now too.

Here’s how smart resellers are adapting 👇

💡 Stick to Fast-Moving, High-ROI Products

Now’s the time to tighten your sourcing filter. Q4 rewards speed over volume.

Focus your buys on proven, fast-selling ASINs with consistent Keepa charts.

Avoid stocking “maybe” items or anything with unstable buy-box history.

Don’t be afraid to liquidate slow sellers – cash flow beats sitting inventory in December.

Your best defense against higher FBA costs is turnover velocity.

Want a faster way to spot those high-ROI winners? That’s exactly what our lead lists were built for — curated, ready-to-buy leads that match the same kind of fast-selling, margin-strong inventory smart sellers are chasing this season.

Instant access. 10+ fast-moving, high-profit OA leads every morning. Lists capped to prevent saturation. No lock-in periods. One flip can cover your month’s subscription. Try our lists risk-free.

Start stacking wins like Ken, one of our long-time subscribers:

⭐⭐⭐⭐⭐

“My experience with lead lists always turned into a dumpster fire until I subscribed to FBA Lead Lists. I have more than tripled my revenue and profits!” - Ken

💰 Re-Check Your Real Margins

Peak fees might only add a few cents per unit, but that stacks up quickly when you’re sending in hundreds of items.

Pull your top 20 SKUs and recalc net ROI after FBA + referral + peak fulfillment fee.

Watch low-priced items especially – a $1 fee bump on a $10 product is a 10% hit.

If a product’s ROI dips too close to your threshold, skip it or wait until mid-January to restock.

This is a great time to tweak your buy-box and ROI settings in your sourcing tools so you’re not chasing thin margins.

⚖️ Play Smart With Pricing & Competition

Since OA sellers don’t control listings, your edge is timing and price strategy.

Monitor Keepa buy-box rotation. If the buy box is being shared by FBA sellers, you can stay competitive without racing to the bottom.

If you see heavy suppression or MFN dominance, wait for rotation to normalize before sending in stock.

Avoid emotional repricing. Focus on sell-through, not just winning the buy box every hour.

🔍 Prep for the Post-Holiday Hangover

Amazon’s peak fees last until January 14, even after the sales rush ends. That means your January payouts will still reflect higher FBA costs.

Slow down sourcing after Christmas. Don’t overbuy while sales are tapering.

Prioritize lightweight, quick-selling inventory for early Q1.

Use that first week of January to clear leftovers and clean your books for tax season.

Lean sellers stay profitable when everyone else is stuck holding excess stock.

🧭 Bottom Line

Peak FBA fees are here, but they don’t have to wreck your Q4.

The winners will be the sellers who know their numbers cold, move fast on replenishable deals, and protect ROI when others panic-source.

This season isn’t about who buys the most; it’s about who buys the smartest.

⚠️ Amazon’s 2026 FBA Fee Hike: What It Really Means for OA Sellers

Amazon has officially dropped its 2026 FBA fee schedule, and let’s just say it’s not pretty. The new rates kick in on January 15, 2026, and while Amazon says the “average increase is just 8¢ per unit,” the real impact tells a different story.

For online arbitrage sellers, these fee changes aren’t just numbers on a chart; they directly affect which products make sense to sell in 2026.

💡 Know Which Products Are Hit Hardest

The biggest pain points are in small standard-size items priced over $10.

Sub-$10 products: minimal change

$10–$50 products: 6 - 8% higher FBA costs

$50+ products: up to 15% more expensive to fulfill

Amazon clearly wants to nudge sellers toward lower-priced items to stay competitive with discount marketplaces.

If you’re selling in categories like beauty, health, or accessories, factor this in when calculating next year’s margins.

⚡Watch the Hidden Placement Fee Trap

This is where many sellers will feel the biggest surprise. Amazon’s placement fees, the extra cost for sending all your inventory to one FC, are going up massively: anywhere from 20% to 100%+ depending on your product’s weight.

If you or your prep center is shipping everything into a single warehouse, expect to pay for the convenience.

📦 Pro Tip: Now may be the time to consider a centrally-located prep center (think Kentucky or Ohio) as they can minimize these costs since you’re shipping shorter distances to Amazon’s network.

💰 Sourcing Strategy Shifts for 2026

These changes flip the script on what “good deals” look like for OA.

Small, lightweight items under $10 will benefit most from the new structure.

Mid-tier $10–$50 items remain workable – just re-check ROI.

High-ticket flips (>$50) will require strong margins to survive the fee bump.

If you’ve been ignoring lower-priced inventory because it seemed “too cheap,” it might be time to take a second look.

🧮 Double-Check Your Math

Now’s the time to update your buy criteria.

Run fresh FBA fee simulations in tools like SellerAmp.

Factor in the upcoming fee increases and new tier structure.

Don’t forget the placement fee when shipping from your prep center; it adds up fast.

Small adjustments in sourcing now can save you from thin-margin surprises next year.

🧭 To Sum Up

For OA sellers, the playbook for next year is simple:

Stay nimble

Track your real margins

Don’t overlook lightweight, low-fee products that move quickly

The most successful online arbitrage sellers in 2026 won’t just know how to source; they’ll know how to source with strategy.

🗞️ Essential Amazon Seller Updates

♻️ Holiday Returns Extended

Amazon’s 2025 holiday return window covers purchases made between Nov 1 and Dec 31, which can be returned until Jan. 31, 2026 (Apple products until Jan 15). Applies to both FBA and FBM orders.

🚚 New FBA Inbound List View

Amazon’s new list view shows real-time receive capacity and delivery windows, helping you choose faster inbound routes. Includes cost estimates, delay alerts, and priority scheduling.

🧰 Arbitrage Corner — OA Tips, Threads & Tools

📦 Q4 Sourcing, Simplified

Q4 separates average OA sellers from the profitable ones, and this thread breaks down how to stay on the winning side. From storefront stalking to FBM pivots, it’s a playbook for smart, fast, and profitable sourcing when everyone else is scrambling.

⚠️ Avoid Q4 Compliance Chaos

Amazon cracks down hard before the holidays, especially in toys and electronics. In this article, the Olsons break down how to catch flags early, act fast, and keep your listings live when others get sidelined.

🔍 Keepa’s Historical Price Filter

Chris Grant just dropped a quick demo of Keepa’s newest power tool, the Historical Price Filter. It lets you dig into what was hot last year and spot products that could pop again this Q4.

🔓 Ungating in Q4: Still a Grind, Still Possible

Ungating’s tougher than ever, but wins are still happening, even for new sellers. The key: persistence (25+ submissions isn’t unusual) and airtight documentation in one clean PDF. A must-read post if you’re fighting the gate this season.

💰 Your COGS Are Lying to You

Most sellers miss half their real costs. and Q4 only magnifies the pain. This post breaks down what actually counts as COGS (shipping, prep, FBA fees, the works) and why bad math kills profit and inflates taxes. Get this right now, before Q4 sales turn into Q1 regrets.

🎓 This Week in Seller School

📚 Blog Posts

How to sell pet supplies on Amazon: start selling on one of the fastest-growing categories today

Amazon Outlet inventory optimization: move underperforming SKUs to free tied-up capital, reduce storage fees, and regain ability to stock up on your bestsellers.

🎥 YouTube

How to write escalations that actually work: learn how to run Seller Support escalations that ACTUALLY move stuck cases

⚡ Quick Clicks — Headlines Worth a Glance

The “Buy Now” button is coming to ChatGPT: Walmart & ChatGPT partner up and take aim at Amazon

Amazon to hire 250K workers this holiday season: ecommerce sales expected to reach $253.4B this November and December

Can we still source from China?: Mike and Dave of the EcomCrew discuss whether sourcing from China is still viable with the trade war back on

🎭 Meme of the Week

Because Amazon selling is serious business… but not too serious.

Want more sourcing memes, weekly drops, and a few laughs between IP claims?

🚀 Tired of Dead Leads? Get Data-Backed Winners Daily.

If you’re ready to source smarter — with IP-safe, ROI-verified leads — we’ve got you covered.

Each of our lead lists is:

🧠 Manually sourced (no scraping, ever)

💰 Built for profit

🛍️ Delivered daily — no guesswork, no fluff

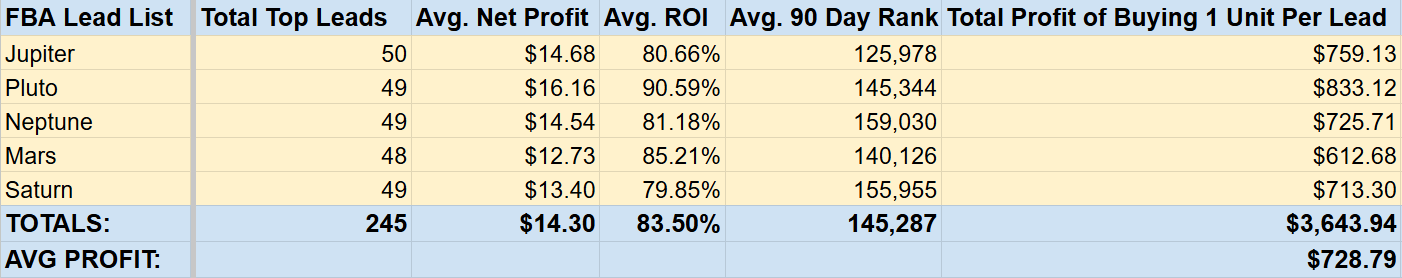

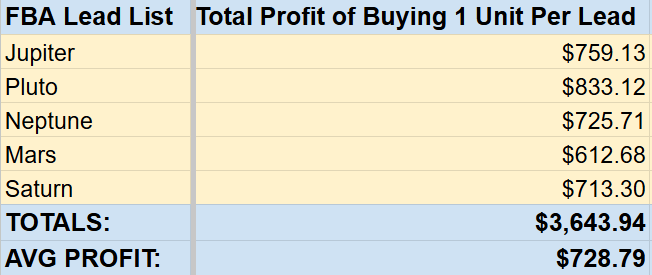

📊 Weekly Recap (10/13–10/17)

🔍 Unique Top Leads: 245

💰 Avg. Net Profit: $14.30

📈 Avg. ROI: 83.50%

🏷️ Avg. 90 Day Rank: 145,287

💸 Total Profit (all lists, buying 1 unit per lead):$3,643.94

This is what you would’ve made in profit — if you bought just 1 unit per lead from our daily lists last week.

💵 Average Profit (all lead lists): $728.79

Here’s what our long-time subscribers had to say about our lead lists:

⭐⭐⭐⭐⭐

“My experience with lead lists always turned into a dumpster fire until I subscribed to FBA Lead Lists. I have more than tripled my revenue and profits!” - Ken

⭐⭐⭐⭐⭐

“I was able to build my business just using these leads; it’s been a great experience for me.” -JC

⭐⭐⭐⭐⭐

“Some insane rabbit trail heads: like a store or brand I’d never heard of that turns sourcing that brand or store and profiting thousands from really just that one lead idea.” -SC

Instant access. 10+ fast-moving, high-profit OA leads every morning. Lists capped to prevent saturation. No lock-in periods. One flip can cover your month’s subscription. Try our lists risk-free.

🤝 Let's Partner Up

Are you an influencer, content creator, or Amazon expert with value to share? We’re always looking for new ways to grow together.

Here’s what we’re excited to explore:

Sharing your content in our newsletter or socials

Offering exclusive deals to our subscribers

Co-creating content that helps sellers scale smarter

Got an idea for a win-win partnership?

📩 Email us at [email protected] — let’s build something great together.

Some links may be affiliate links. We may get paid if you buy something or take an action after clicking one of these. We appreciate the support.

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.