- Seller Snacks by FBA Lead List

- Posts

- Amazon’s New Rules Could Slow You Down — Here’s Why

Amazon’s New Rules Could Slow You Down — Here’s Why

From ChatGPT’s “Instant Checkout” to Amazon’s payout delays and prep service shutdown, this week’s Seller Snacks breaks down what’s changing — and how to stay ahead of it all.

Welcome back to Seller Snacks, your weekly buffet of ecommerce goodness.

This week, we look into Chat GPT’s new “Instant Checkout Feature”, a China-dominated Amazon marketplace, Amazon’s new DD+7 policy, and the possible fallout once Amazon closes its in-house FBA Prep Service.

Also, subscription slots for our lead lists are quickly getting filled.. Subscribe today and unlock your Q4 advantage. Don’t get left behind.

On Today's Menu:

Let’s eat!

🤖 ChatGPT’s Instant Checkout: A Quiet Shake-Up for Amazon Sellers

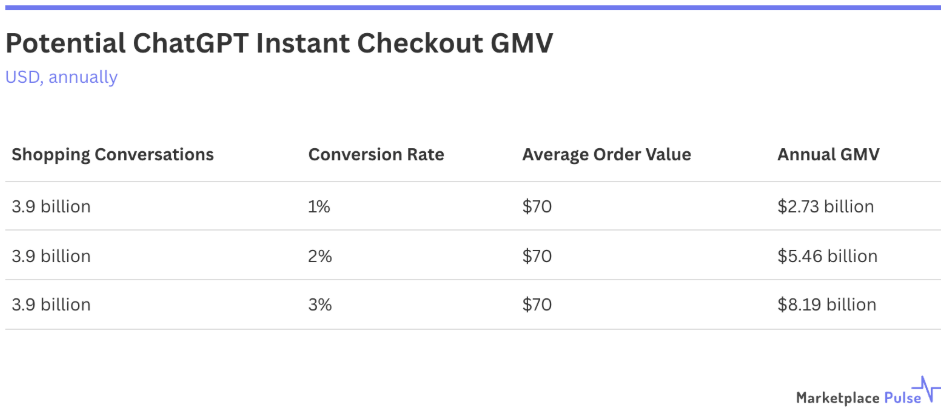

OpenAI just turned ChatGPT into a shopping assistant. Its new Instant Checkout feature lets users find and buy products directly in chat — no search results, no ads, no scrolling.

Right now, it connects mainly to Shopify and Etsy, pulling real-time listings, prices, and inventory. But the move has big implications: if shoppers can discover and purchase through conversational search, Amazon’s pay-to-play ad model takes a hit.

Some have called it “an instant threat” to Amazon’s ad revenue: the same ads most sellers depend on for visibility. Instead of bidding on keywords, ChatGPT will recommend products naturally based on what users say they want.

For Amazon sellers, here’s what this shift signals:

Discovery is changing. Product visibility may depend more on natural language relevance than keyword rank. Optimize titles and bullet points for conversational intent, not just SEO.

Diversify your reach. Explore Shopify or other marketplaces early. ChatGPT is tapping into these catalogs first.

Focus on fundamentals. Great offers, clean data, and fast shipping will matter even more when algorithms decide what to show, not ad budgets.

Conversational commerce is coming fast. It won’t replace Amazon overnight, but it’s rewriting how shoppers discover products, and which sellers or brands get seen.

🌏 The New Amazon Reality: Competing in a China-Dominated Marketplace

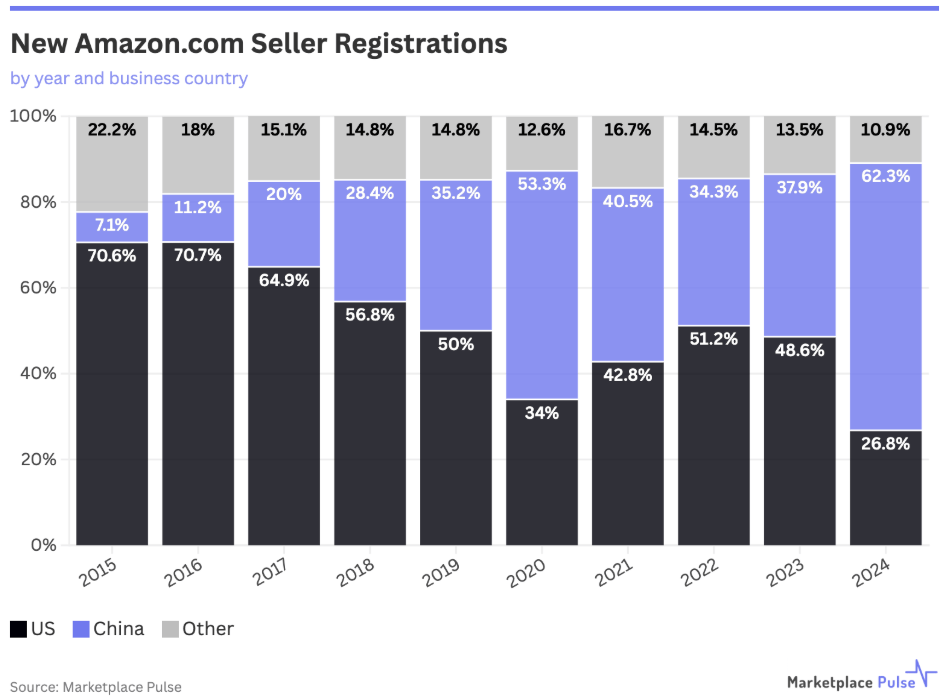

For the first time ever, Chinese sellers now make up over 50% of all active sellers on Amazon worldwide, according to new data from Marketplace Pulse. It’s a milestone that’s been building for years, and it officially marks a new phase in Amazon competition.

In 2015, only about 7% of new sellers were based in China. By 2024, that number jumped to 62%. The shift was powered by faster factory-to-Amazon pipelines, government-backed export programs, and, more recently, AI tools that make translation, listing creation, and market research effortless.

But here’s the catch: while Chinese sellers now dominate by volume, U.S. sellers still lead in average revenue, generating roughly twice as much per seller. That means there’s still room and advantage for sellers who can play smarter, not just cheaper.

For US Amazon sellers, this trend comes with a few takeaways:

Expect tighter competition on fast-moving ASINs. Prices will move faster and margins will compress more quickly.

Lean on data and automation. If you’re not using the same tools your competitors are, you’re playing catch-up.

Double down on differentiation. Focus on unique bundles, better listing optimization, and niche selection — areas where speed and local insight still win.

The Amazon landscape is global now. But that doesn’t mean smaller sellers are outmatched. It means the game just got more strategic.

💸 What Amazon’s New DD+7 Rule Means for Your Cash Flow

Amazon’s latest policy change, DD+7, has sellers talking, and for good reason:

Starting March 12, 2026, Amazon will begin holding funds until seven days after a customer’s delivery date before releasing payouts.

That means if your order ships on January 1 and arrives January 3, your payout won’t hit until January 11.

Amazon says the change gives buyers more time to receive or return products and helps the company manage fees more accurately. But for sellers, it means one thing: cash flow just got tighter.

Comments on a forum thread show growing frustration. Many see DD+7 as Amazon keeping their money longer, especially since delivery confirmations aren’t instant (and sometimes never show for untracked orders).

Here’s why OA sellers should pay attention:

Slower cash cycles: Every extra day Amazon holds your funds delays your ability to reinvest in new inventory.

Delivery-based risk: If an order doesn’t scan as delivered, the payout clock may never start.

Q4 pinch: During peak season, when sales volume and supplier payments surge, this delay could hit hardest.

How to adapt:

Slower cash cycles: Every extra day Amazon holds your funds delays your ability to reinvest in new inventory.

Delivery-based risk: If an order doesn’t scan as delivered, the payout clock may never start.

Q4 pinch: During peak season, when sales volume and supplier payments surge, this delay could hit hardest.

DD+7 won’t stop sales, but it changes how fast you can scale. Smart OA sellers will treat this as a logistics and finance challenge, not a surprise.

🔧 Adjusting After FBA Prep: What Sellers Need to Do Now

Starting January 1, 2026, Amazon will shut down its in-house FBA Prep Service, the program that handled labeling, bagging, and other prep tasks for sellers.

A survey of 500 U.S. sellers found:

64% expect the change to significantly impact operations.

92% expect higher costs.

72% used Amazon’s prep for at least a quarter of their shipments.

For years, sellers relied on Amazon’s all-in-one system to simplify logistics. With that safety net gone, everyone will need to either build their own prep workflow or outsource to a trusted prep center.

The biggest shifts ahead: higher operational costs, stricter labeling and packaging requirements, and more moving parts to manage during peak seasons. Sellers who adapt early by tightening their logistics, simplifying SKUs, and forming reliable prep partnerships will have the smoothest transition.

If you’re looking to outsource prep because of this change, Elite Prep Center is a recommended choice for OA sellers. They handle FBA, WFS, and FBM with fast turnaround and full compliance. Also, apparel and footwear is sales tax-exempt in New Jersey, and will help you save while scaling.

Mention “FBA Lead List” to get your first 100 units free.

🗞️ Essential Amazon Seller Updates

💰 New: Partial Refunds for FBA Returns

Amazon now lets you issue partial refunds without requiring a return in the US, UK, and select EU markets. Save on shipping and processing costs, set custom refund percentages, and choose which products qualify. Enable it under FBA Settings → Partial Refunds.

🗣️ Drive Success with the Voice of Customer Dashboard

Amazon has updated the Voice of Customer dashboard with new insights to help sellers reduce returns and improve buyer experience. A new High Return Rate rating lets you track problematic products faster, while improved Negative Customer Experience metrics provide clearer feedback trends. Use these tools to identify issues, analyze feedback across marketplaces, and take action to boost product performance.

📈 New: Returns & Recovery Insights Dashboard

Amazon has launched the Insights and Opportunities dashboard to help sellers track and improve return performance across both FBA and seller-fulfilled orders. The tool provides product-level return data, historical trends, and tailored recommendations to reduce returns and improve recovery. You can also view new FBA Recovery metrics for better visibility into customer-returned inventory.

🧰 Arbitrage Corner — OA Tips, Threads & Tools

📦 Survive FBA Peak Like a Pro

Inbound delays. restock limits. West Coast congestion. All of these make Q4 a minefield for FBA sellers. This quick-hit thread breaks down how to prep smarter, ship earlier, and protect your Buy Box when Amazon’s warehouses get slammed. Perfect checklist reading before peak chaos begins.

🔍 Keepa’s Stealth Power Move

Keepa just rolled out a quiet but game-changing update: you can now browse the entire historical product catalog of any Amazon seller using their Seller ID. It’s like storefront stalking 2.0. Use it to uncover competitor replen trends, past seasonal winners, or wholesale distributor leads.

🧠 Beat Q4 Decision Fatigue

Q4 sourcing can feel like chaos — every lead looks profitable until it isn’t. In this episode of The Full-Time FBA pod, Stephen and Rebecca break down how to replace panic buying with calm, data-driven decisions. Learn how to use a simple sourcing checklist to avoid bad buys, protect cash flow, and build real confidence during the busiest season of the year.

If you want to take even more guesswork out of your sourcing, our lead lists are built with that same goal — curated, data-backed leads so you can make confident buys without analysis paralysis.

🧩 Inside the Mind of an OA Rookie

Meet Michael, a new seller who joined Jim Cockrum’s community with questions (and a healthy dose of doubt). In this Silent Sales Machine Radio episode, he and Jim dig into ungating, drop shipping, done-for-you models, and how to spot real opportunities on Amazon. It’s a refreshingly honest talk that captures what most new OA sellers think but rarely say out loud.

📊 What Amazon’s Sales Rank Really Tells You

Amazon’s Best Seller Rank (BSR) is more than just a badge; it’s a living metric. This GoAura deep dive explains how BSR is calculated (recent vs. historical sales, category dynamics, weighting), what it doesn’t show, and how resellers can use it smartly (trend spotting, sourcing decisions, risk checks). Great read for anyone who’s been using rank as a shortcut without understanding its limits.

🎓 This Week in Seller School

📚 Blog Posts

What Amazon Shippers Should Prioritize This Peak Season by Supply Chain Dive

Amazon Outlet Inventory Optimization: Focus on Bestsellers and Free Up Space by SellerEngine

Amazon Selling Fees and FBA Fees: Calculator for 2025 by EcomCrew

⚡ Quick Clicks — Headlines Worth a Glance

Amazon Shipping’s Peak Season Surcharges: peak season surcharges will apply from October 26,2025 until January 17, 2026, and will peak from November 23 to December 27

Amazon Grocery to Feature over 1k Items: most of which are priced under $5 to prioritize accessibility

Amazon Accelerate 2025: 5 Updates Brands Have to Know: smarter AI, faster fulfillment, and actionable insights

🎭 Meme of the Week

Because Amazon selling is serious business… but not too serious.

Want more sourcing memes, weekly drops, and a few laughs between IP claims?

🚀 Tired of Dead Leads? Get Data-Backed Winners Daily.

If you’re ready to source smarter — with IP-safe, ROI-verified leads — we’ve got you covered.

Each of our lead lists is:

🧠 Manually sourced (no scraping, ever)

💰 Built for profit

🛍️ Delivered daily — no guesswork, no fluff

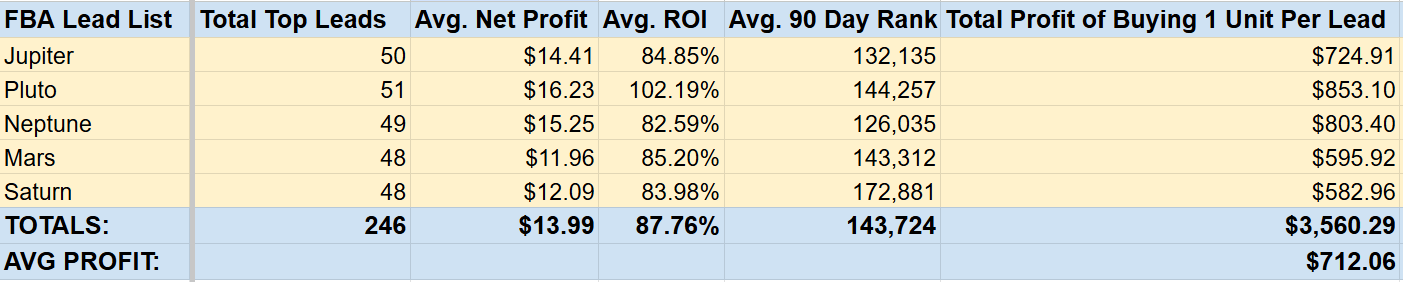

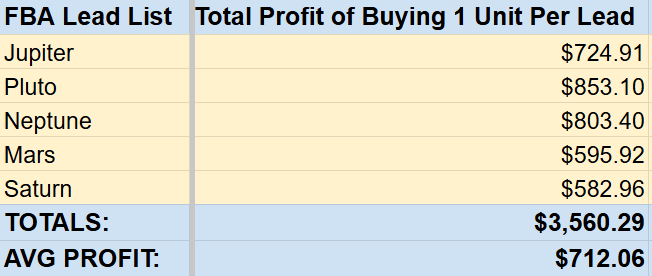

📊 Weekly Recap (9/29–10/4)

🔍 Unique Top Leads: 246

💰 Avg. Net Profit: $13.99

📈 Avg. ROI: 87.76%

🏷️ Avg. 90 Day Rank: 143,724

💸 Total Profit (all lists, buying 1 unit per lead): $3,560.29

This is what you would’ve made in profit — if you bought just 1 unit per lead from our daily lists last week.

💵 Average Profit (all lead lists): $712.06

Here’s what one of our long-time subscribers had to say about our lead list:

⭐⭐⭐⭐⭐

“My experience with lead lists always turned into a dumpster fire until I subscribed to FBA Lead Lists. I have more than tripled my revenue and profits!

Every time I've tried a lead list, the same thing always happens. A race to the bottom in sales price, and I'm lucky just to break even on my investment.

With FBA Lead Lists, there may be a dollar or so price drop, but rarely any more than that, and a surprising number of items experience a dollar or two sales price increase.

What I appreciate about the lists is that I'm given a solid sell price based on historical data, accurate sourcing information like color, size, etc, a suggested purchase amount, and any coupons that are out there.

Better and more cost-effective than any VA I have hired on my own. This has been a real game-changer for me, and I really do appreciate the hard work everyone puts into making this happen.”

-Ken

Only the fastest sellers thrive in Q4. Gain exclusive access to our lead lists and stay ahead of the competition.

🤝 Let's Partner Up

Are you an influencer, content creator, or Amazon expert with value to share? We’re always looking for new ways to grow together.

Here’s what we’re excited to explore:

Sharing your content in our newsletter or socials

Offering exclusive deals to our subscribers

Co-creating content that helps sellers scale smarter

Got an idea for a win-win partnership?

📩 Email us at [email protected] — let’s build something great together.

Some links may be affiliate links. We may get paid if you buy something or take an action after clicking one of these. We appreciate the support.

Delivered to your inbox every week.

Need-to-know seller content only. No spam. Unsubscribe at any time.